What are Rug Pulls and how to avoid them?

Besides all the great opportunities the crypto space has to offer there are also bad actors interacting with this ecosystem. A lot of investors have already experienced a so called pump and dump scheme, also known as rug pull.

A rug pull happens when the developers siphon off their investors' money and then leave the project abadoned.

Types of rug pulls

- Stealing liquidity

In this type of scam, developers create a liquidity pool with their own token and a valid cryptocurrency (i. e. Ether) and allocate initial funds for the liquidity pool. Once investors buy into the project their funds get stored in the liquidity pool. After some time the developers of the project pull out the entire amount of the valid cryptocurrency from the liquidity pool. All investors get left with the bought token, which is now worthless. - Disabling the ability to sell tokens (Honeypot)

In this case, investors buy into a project that has certain coding applied to not allow the buyers to sell the created token ever again. When the price of the cryptocurrency rises rapidly the developers then sell their tokens, while normal investors get left bagholding the worthless coin. - Developers cashing out

Here, developers create a worthless project and praise it as new innovation or with other marketing campaigns. While new investors are able to buy a specific amount of the coin, most of its supply is owned by the developers. After a surge in price the developers then sell-off their shares making the price fall into oblivion.

Bitconnect and Squid Game token

Bitconnect was a multi-level ponzi-scheme and crashed in January 2018

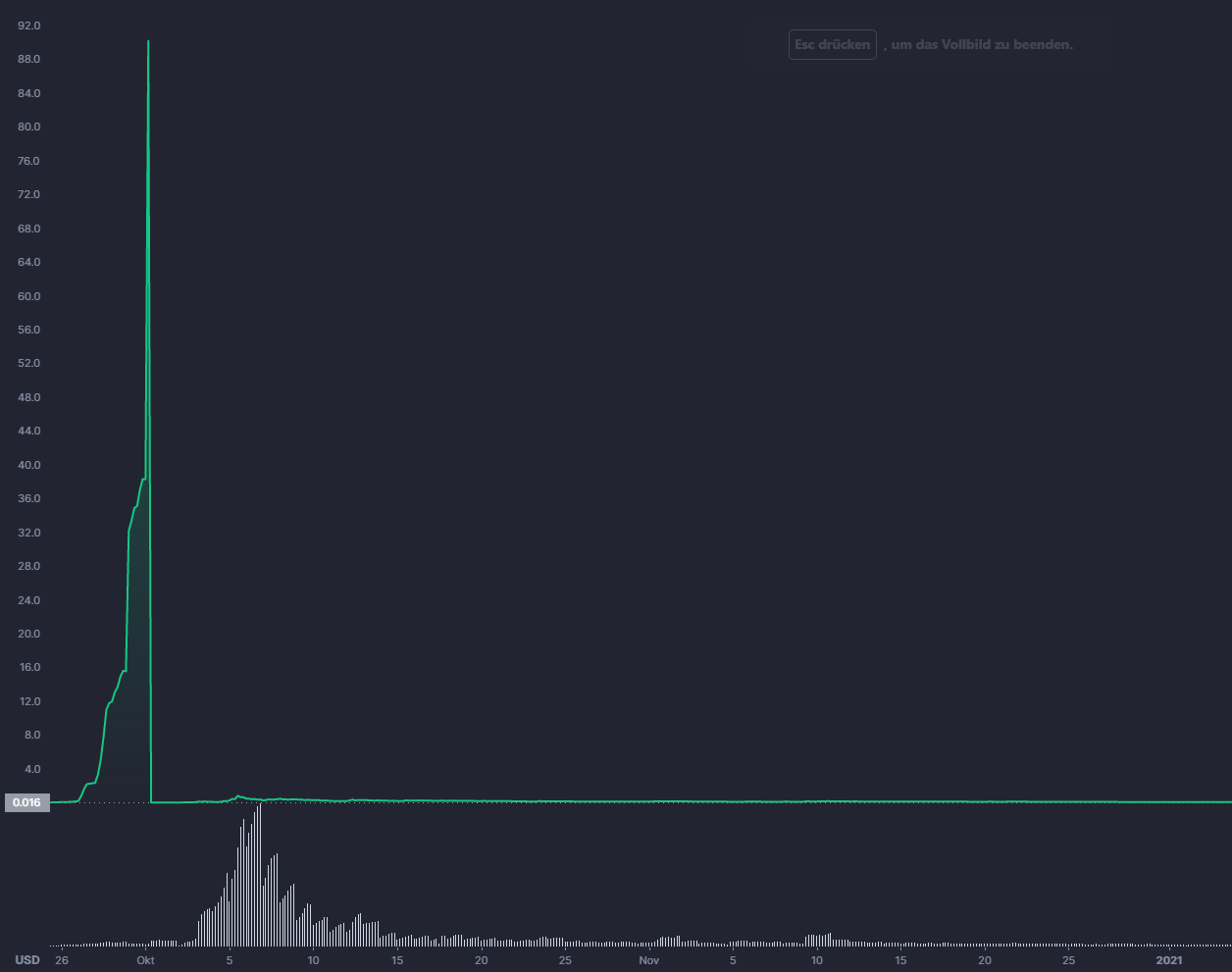

The Squid Game token rose over 2,300,000% within 2 weeks before the developers pulled out funds of over $3.4 million. The token was a so called honeypot.

How can you identify a rug pull?

- the project wants to revolutionize the crypto space out of nowhere

- anonymous developers

- check the liquidity of a project (10%-40% liquidity compared to market cap)

- lack of communication and community engagement

- always check the whitepaper

- try to check the contract address with sites like BSCheck.